What Does Full Coverage Car Insurance Consist Of

How much does full coverage car insurance cost.

What does full coverage car insurance consist of. However what is considered full coverage auto insurance by some is the combination of comprehensive insurance collision insurance and liability insurance. What does full coverage car insurance consist of. Usually full coverage is considered to have the following. That being said its important to be informed about what various insurance.

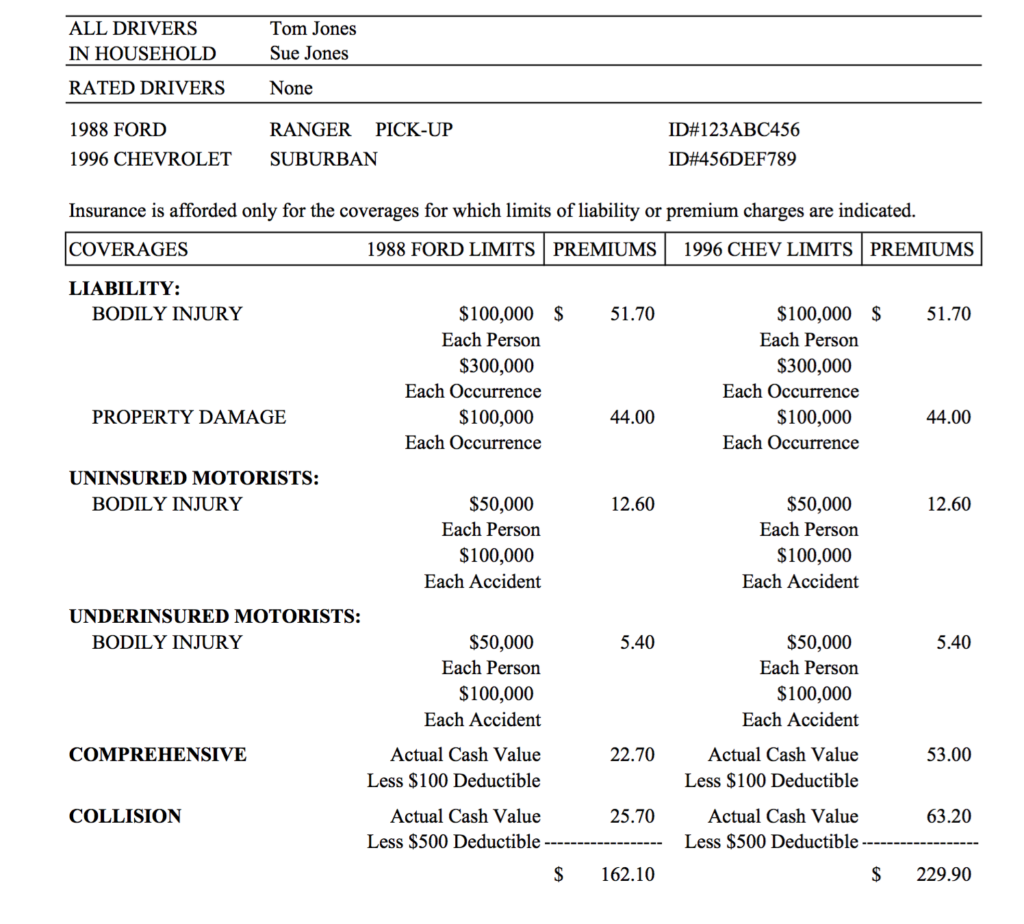

You might also hear people use the terms comprehensive insurance and full coverage insurance interchangeably even though this is not technically correct. This term is slightly misleading in the fact that every insurance policy will require you to pay something. The damage you do to others up to your liability limits. Full coverage liability of 100000 per person injured in an accident you cause up to 300000 per accident and 100000 for property damage you cause.

But theres really no such thing as full coverage for your car. Sometimes the coverage is not listed so you have to ask what your policy offers. A typical full coverage policy liability comprehensive and collision uninsured motorist and medical coverage should cover. If car rental is an important coverage to you make sure to request it at the time you set up your policy.

What does full coverage car insurance consist of. Having a full coverage auto insurance policy doesnt mean you have full protection no matter what. Liability insurance can cover expenses from an accident that you cause while youre drivingthese expenses may include repairs for damaged property or medical bills and lost income if youve injured someone. Depending on your circumstances it may even mean you dont even have good enough protection.

Full coverage car insurance typically consists of these coverages. How does full coverage insurance work. You have probably heard the term full coverage in relation to car insurance. When people talk about full coverage car insurance theyre often referring to a combination of coverages that help protect a vehicle.

This is a bit tricky because you need to weigh not only the price but also what is offered for that price. Instead of relying on a full coverage policy ask yourself what coverage and limits best meet your needs. The term full coverage is also used to refer to liability limits beyond the state minimum liability insurance required to drive legally. Some insurance carriers offer a limited amount of car rental reimbursement when you purchase full coverage auto insurance.

When the time comes to purchase an auto insurance policy you obviously want to look for the best deal. You will also want to read reviews of insurance companies to see which ones have high customer satisfaction rates as these will be the best to work.